How Michigan Funds Schools

Please put away your books and notes and let’s begin our discussion of school funding with a high-stakes multiple choice test:

1. Does Michigan fund schools from:

A. Local sources B. Federal sources C. State sources

2. Does the revenue come from:

A. Property taxes B. Income taxes C. Sales taxes

3. Is school money allocated per:

A. District B. School C. Pupil

As with most interesting questions, there is actually no easy solution. While the answers in Michigan now tend toward C., the best correct response is the old standby answer D: all of the above. School funding in Michigan is so complex that even our political and economic leaders often fail to understand it. For more clarity, we need to look at where the money comes from, where it goes, and how the system has changed.

The best place to begin is the system Michigan used to use to fund schools (and the one that many people think continues to this day).

Before Proposition A

Until 1994, most school funding came from local property taxes in amounts that depended on how much a school district could get voters to approve. This allowed for local control, but it also allowed high inequality. In the early 1990s, the state legislature responded to concerns about high property taxes by simply eliminating property taxes as a source of school funding.

The legislature gave voters a choice between a ballot initiative called Proposition A based largely on sales taxes and a “statutory alternative” based on income and business taxes that would come into effect if Proposition A failed.

Voters approved Proposition A by 69% in part because it responded both to those who thought property taxes were too high and those who sought more equal funding for schools, but in appealing to many different groups the proposition created a very complex funding system.

Where does the money come from?

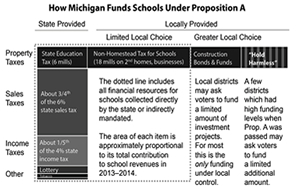

• Without access to local property taxes to fund school operations, Proposition A turned to almost every other possible source:

• Sales taxes and other state taxes. Proposition A took most school revenue from state sales tax (including a 2% increase imposed by Proposition A), state income tax, and a combination of smaller state- wide revenue sources including the lottery and cigarette taxes.

• State property taxes. Proposition A took the unusual step of levying a statewide property tax of 6 mills ($6 on every $1,000 of a home’s state equalized value).

• Local property taxes on non-homestead property. Proposition A did not eliminate school taxes on second homes, rentals, or commercial property (non-homestead), but limited school taxes on these to an 18 mill maximum. Responsibility for collecting these taxes lies stay with the localities, and school districts must from time to time renew the millage by citizen vote, though no district in the state have rejected a levy in this category.

Local homestead property taxes are still in the picture, but only in limited ways.

If something happened with our soundness, we believe there is a solution to any maladies in a preparation. What medicines do patients purchase online? Viagra which is used to treat impotence and other states coupled to erectile dysfunction. Learn more about “sildenafil“. What men talk about “viagra stories“? The most vital aspect you should look for is “sildenafil citrate“. Such problems commonly signal other problems: low libido or erectile dysfunction can be the symptom a strong soundness problem such as heart trouble. Causes of sexual dysfunction include injury to the penis. Chronic disease, several medicaments, and a condition called Peyronie’s disease can also cause sexual disfunction. Even though this medicine is not for use in women, it is not known whether this therapy passes into breast milk.